Transforming how a leader in housing finance goes to market

Reorient a mission-driven organization toward growth

Following the 2008 housing crisis, a large government-sponsored entity(GSE) entered conservatorship with a public mandate to ensure housing affordability, accessibility, and stability. Over the next decade, this mission-driven focus defined its operational model. But as the organization matured, leadership began asking a critical question: Can we still fulfill our mission while becoming more growth-focused?

To answer that question, the new chief marketing officer sought to pilot a modern, growth-oriented approach to sales and marketing. The organization needed a high-impact test case—one that could demonstrate the possibilities for transformation across the organization.

Build a beacon for growth marketing at scale

We partnered with the organization’s credit-risk transfer (CRT) group and the CMO to create a “beacon initiative”—a proof-of-concept designed to model a new, growth-focused approach to marketing for the entire organization.

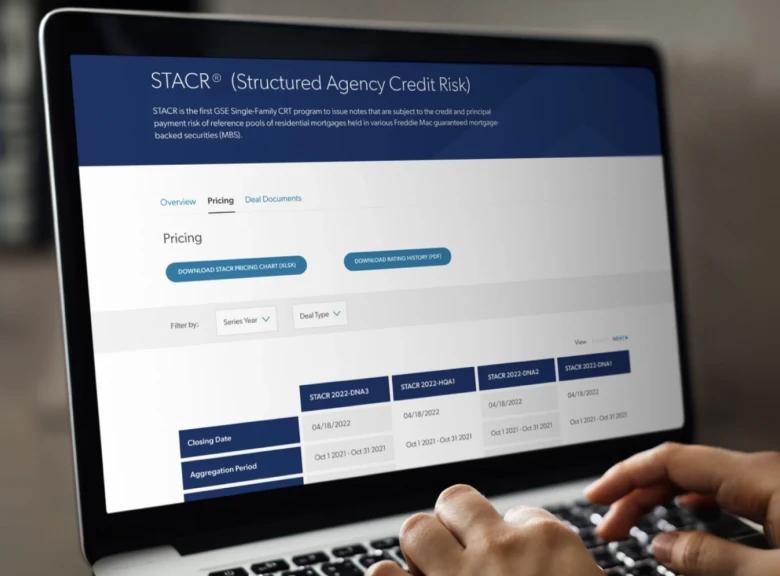

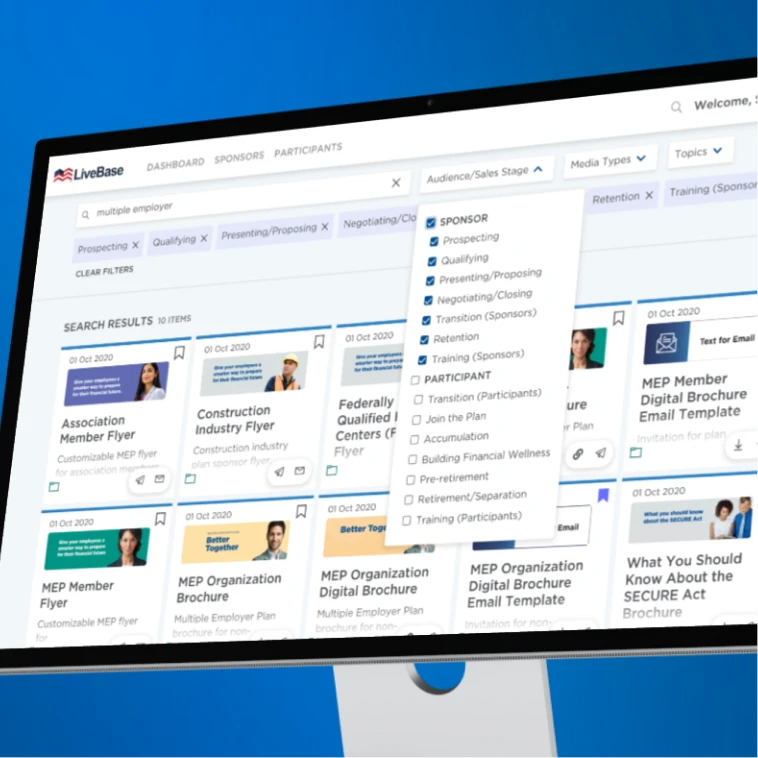

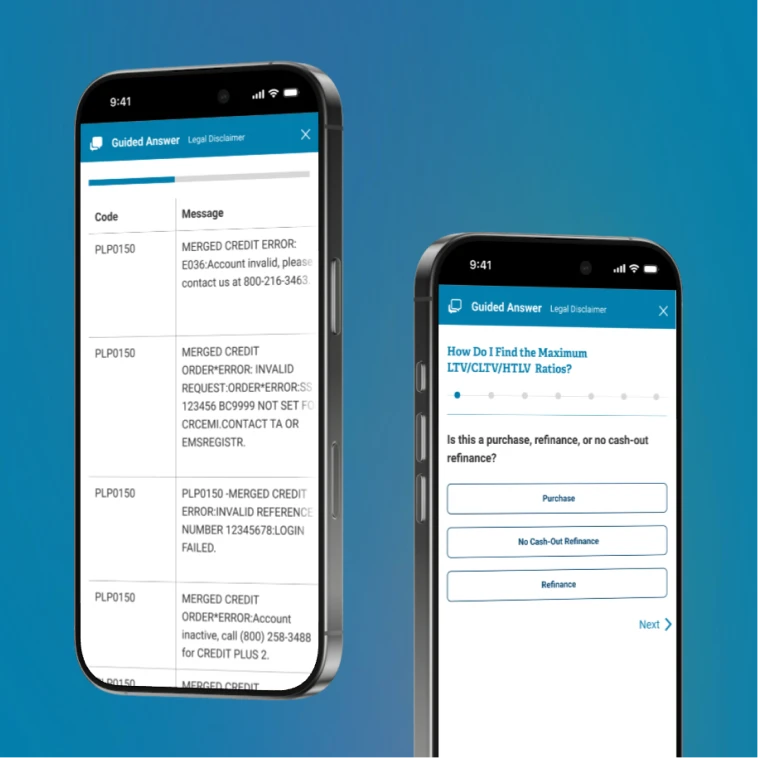

We redefined the group’s positioning, brand, and messaging. We rebuilt the digital experience to make it easier for investors to find relevant offerings and understand complex products. And we implemented new MarTech tools controlled by the marketing team—enabling agile content development, targeted campaigns and performance measurement.

This wasn’t just a refresh—it was a systemic change in how CRT engaged its market. The success of the CRT beacon helped secure buy-in for enterprise-wide transformation.

New ways to grow, and a blueprint for what’s next

The relaunched CRT site increased investor engagement and reduced time-to-close, as the new brand and positioning elevated CRT’s profile and validated the growth strategy. Fifteen follow-on pilots were launched to replicate success across the GSE.

The beacon’s streamlined MarCom operation and increased investment in marketing tools became the model for rebranding the broader Single-Family business.

- +35Investor engagement

- -22%Time-to-close

- 15Follow-on pilots

A cornerstone of housing finance

This GSE is an innovator in housing finance, providing liquidity, stability and ownership opportunity to the US housing market.

Core to the mission is the Credit Risk Transfer division, one of the fastest growing and most innovative parts of the enterprise. CRT makes it possible for the U.S. Treasury Department to offload credit risk from U.S. taxpayers to third-party investors.