Helping lenders help people become homeowners

Modernize an antiquated but essential resource

A vital force in U.S. housing finance relied on its Seller/Servicer Guide to communicate essential mortgage policies to lenders. But the Guide was the ultimate legacy platform: an unwieldy, 3,000-page PDF that was difficult to navigate and frustrating to use. More alarming, the major competitor’s digital version was highly preferred customers.

Lenders needed immediate, reliable answers to support borrowers in an increasingly competitive mortgage market. The organization needed to modernize how policy information was accessed—without altering the content itself, which was tightly controlled by legal and regulatory requirements.

Stop thinking like a publisher—and start acting like a problem solver

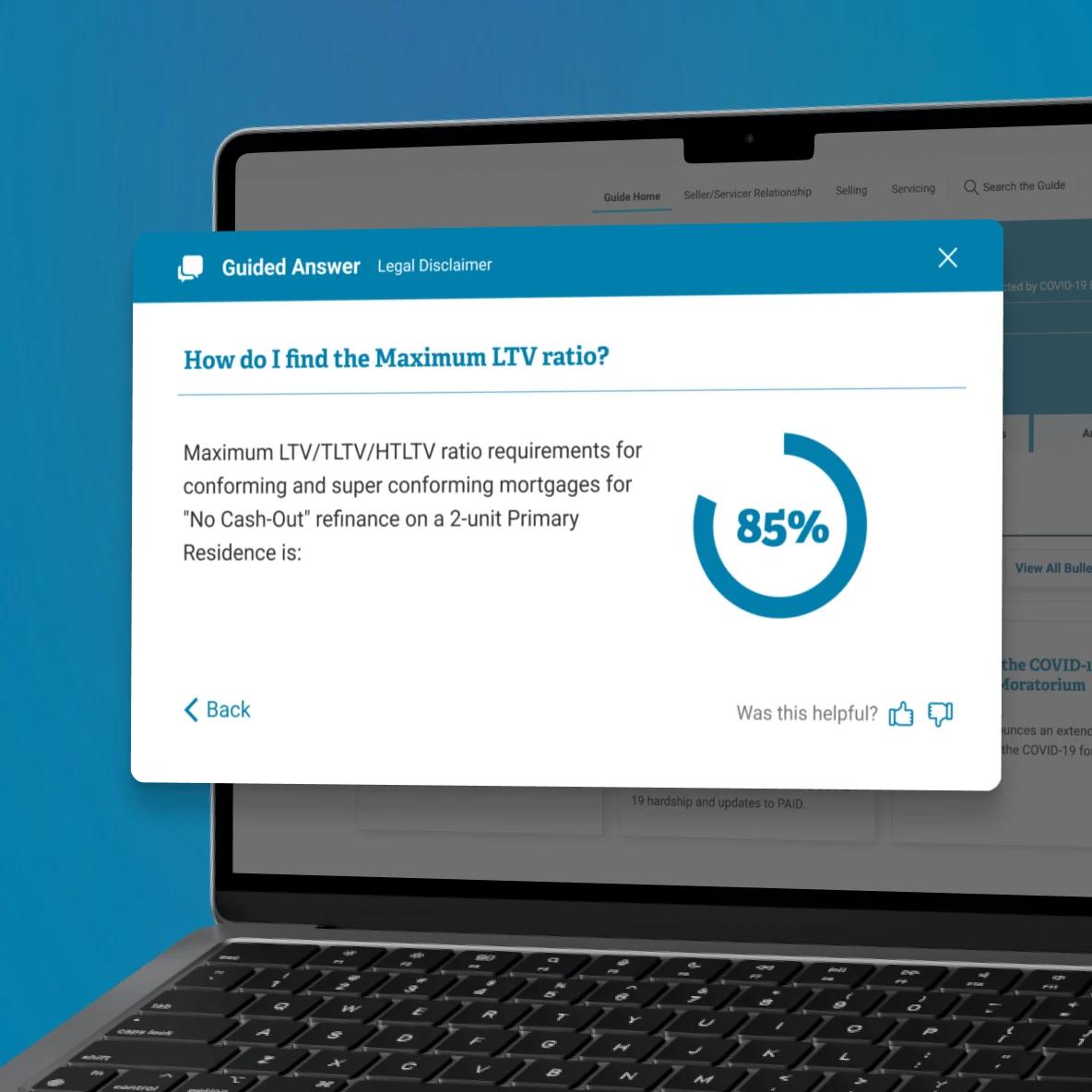

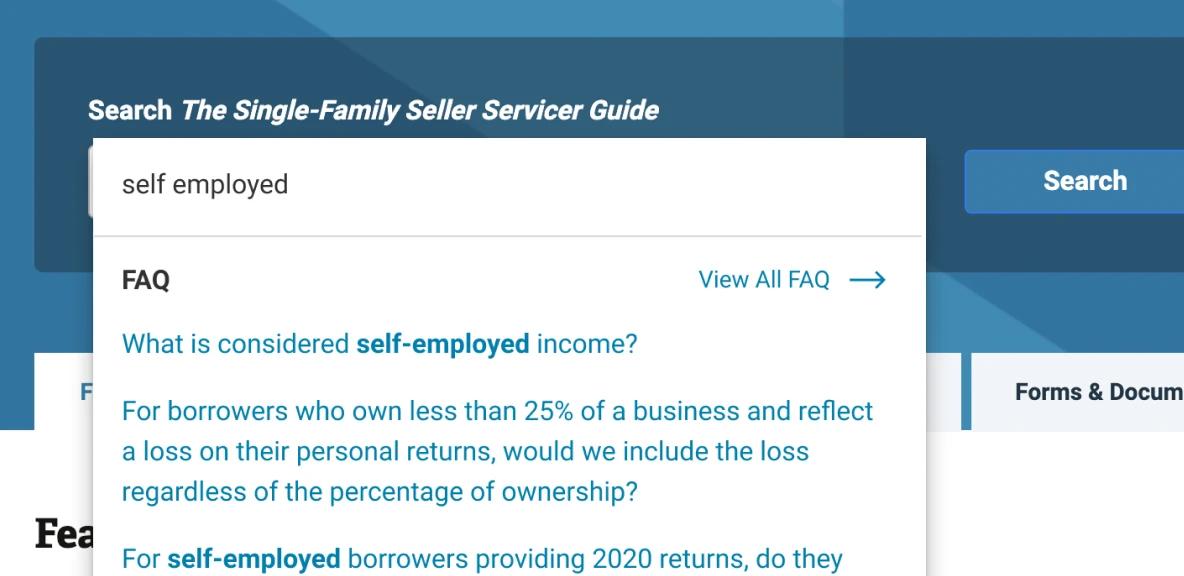

User research confirmed people didn’t want to read the Guide—they wanted it to answer questions. So we helped the client shift its internal mindset: the Guide wasn’t just a document—it was a smart, proactive guidance system that would lead users to the answers they needed.

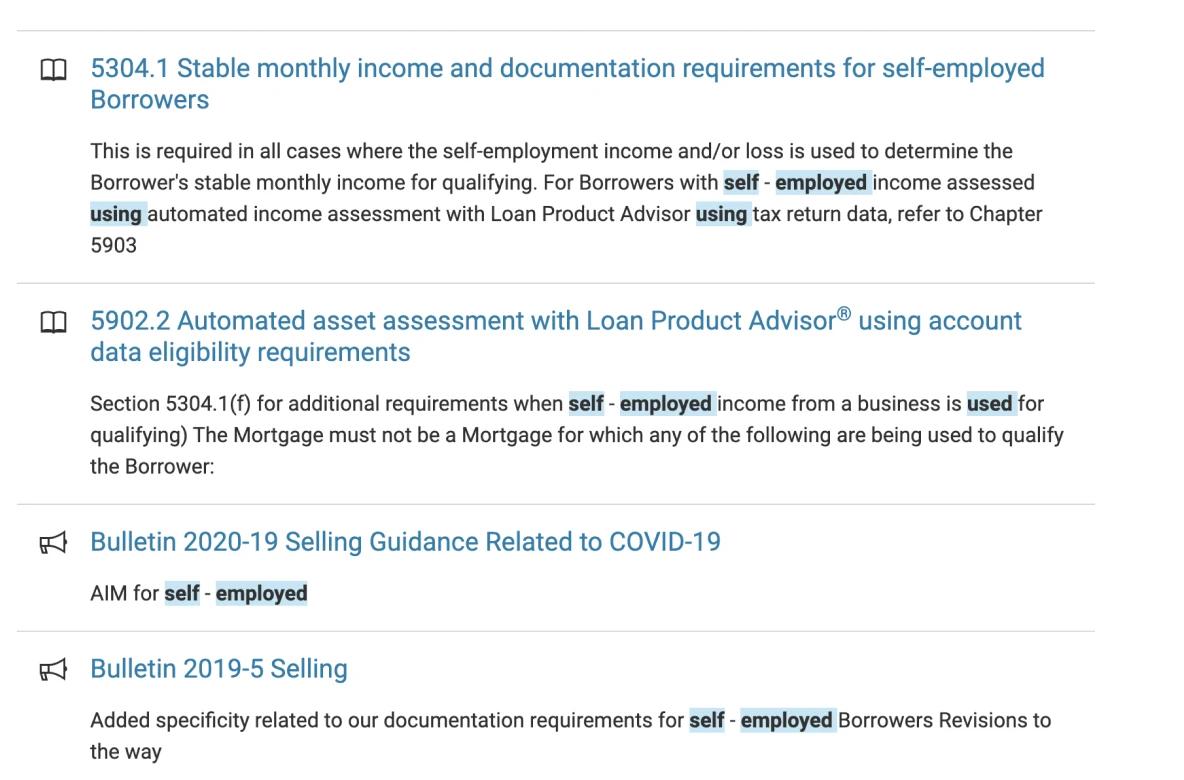

We introduced the concept of the “intermediary interface”: a UX layer designed to anticipate needs and deliver direct, relevant answers for common borrower scenarios. Instead of digging through static pages, users could now engage with intelligent interfaces that pointed them to the right information instantly.

The innovative solution included content fragment syndication, enabling portions of Guide content to surface in external tools and workflows; answer-focused design, prioritizing fast decision-making over document structure; and cross-functional alignment, ensuring legal, technical and user experience goals were met simultaneously.

Faster answers, happier customers

The organization’s lenders were able to access policy answers more quickly and with less effort—spending 20% less time on the site and requiring fewer calls to customer support. Internal teams—also heavy users of the Guide—were similarly able to get to the information they needed faster. Operational costs went down, C-Sat scores rose and the organization reaffirmed its role as an innovation leader in housing finance.

- 20%Less time on site

- -18%Support calls

- +12C-Sat score

A cornerstone of US housing finance

This GSE is innovator in housing finance, providing liquidity, stability and ownership opportunity to the US housing market.